Real Estate Investment Opportunities

Monday, April 15, 2013

Monday, January 28, 2013

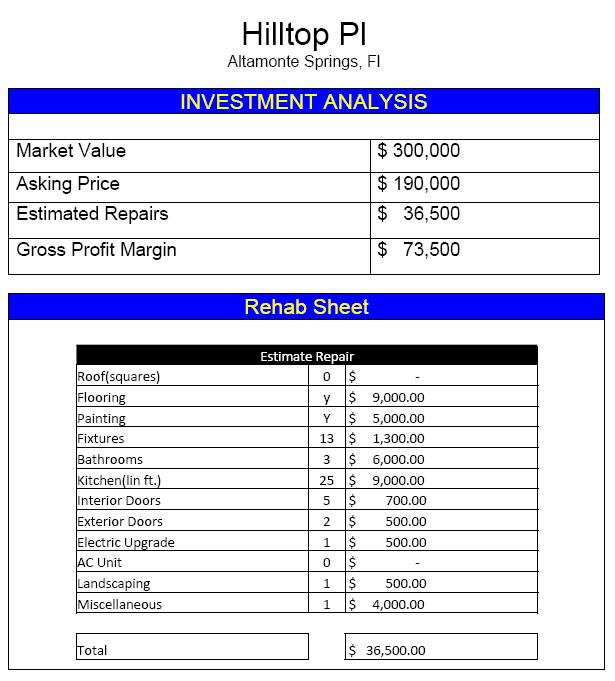

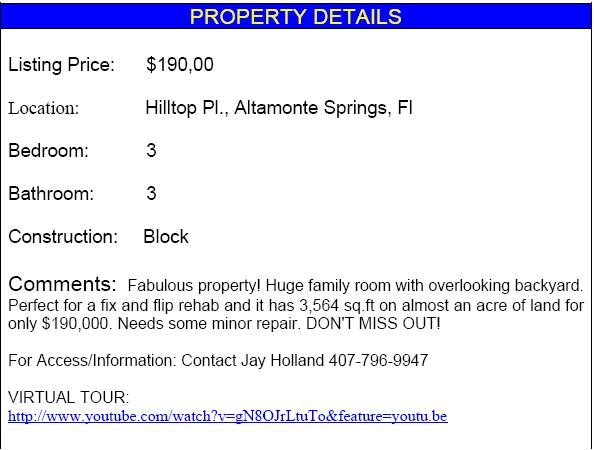

Alta Monte Springs Huge House Investment

Wednesday, January 23, 2013

Sunday, January 20, 2013

Tuesday, October 25, 2011

Subprime Mortgages

www.myroihome.wordpress.com

www.ihd.postlets.com

It sounds terrible. Subprime Mortgage. But in reality it has many different benefits that other loans do not.

A subprime loan typically has a higher interest rate than other loans because the people who need it usually have a poor credit history or very low credit score.

These high interest loans do make people pay a lot more for a house they want but actually have some benefits.

There are many financial institutions that specifically deal with subprime lenders. This means they know how to help those with poor credit.

Some banks also offer prime and subprime mortgages because they know their community well and some areas just don’t have the types of jobs that prime mortgages will need to ensure their monthly payments.

It can be embarrassing to go to a local bank if you live in a relatively small town so you may want to choose a subprime only lender.

A good benefit of a subprime mortgage is that you don’t have to take the time to raise your credit score. This can take years of payments and credit building and many people just don’t have the time for all of that.

They realize they made some late payments here and there but are past that and want to own a home. Not everyone with bad credit got it by not paying their bills on time.

Many times, wives and husbands who are irresponsible can annihilate their significant other’s credit and even after divorce, it’s still bad.

A subprime mortgage to many people is a chance for a new beginning.

Rard Haugabrooks -Chief Review Appraiser

Real estate professional with over 16 Years of experience in residential and commercial appraisal/review (7 Years), foreclosure/loss mitigation (8 years), finance (4 Years), supervisory /management (13 Years), acquisition (7 years) and marketing / sales/sales management (7 years) experience. In depth knowledge and experience in Foreclosure Related Topics including Foreclosure Procedure in multiple states, Loss Mitigation, Bankruptcy, Financial/Credit Counseling Innate ability to horizontally fashion long term business plans and vertically design processes to execute business plan milestones. Consistent track record of increasing productivity, improving quality, enhancing customer satisfaction and reducing cost through management style and knowledge of information systems.

Central Florida realize their potential and acts as a uiding light through the rehabilitation process and rejuvenating the community one home at a time!

Monday, October 24, 2011

Second Mortgage What Is It Exactly

The real term for this is called a home equity loan. This is a common loan type that homeowners can use for whatever they want.

A home equity loan requires that you use your house for collateral just like a normal home loan. There are

different types of home equity loan out there and you can always use the money for whatever you want.

College, bills, and home repairs are some common uses. You will need outstanding credit to be approved for this kind of loan though.

A closed end type home equity loan gives you a big chunk of money immediately and you can’t get another loan until this one is fully paid.

The amount you can get depends on factors such as how much your home is worth, your income, credit score, and similar things. A closed end loan usually comes as a fixed rate type and allows you up to 15 years to pay it off.

An open ended home equity loan is a little different. This loan will let you borrow money whenever you have a need for it.

The loan lender will set up a line of credit that is pretty much based on all the same factors as the closed end loan. These usually have an adjustable rate and you can make payment for 10, 15, or even 30 years.

So why are these called second mortgages Because you are adding yet another loan payment that uses your house as collateral and adding another monthly payment. Though tempting, it can cause you a lot of problems in the future.

Rard Haugabrooks -Chief Review Appraiser

ROI Homes is helping investors throughout Central Florida realize their potential and acts as a guiding light through the rehabilitation process and rejuvenating the community one home at a time!

Friday, October 21, 2011

Signs Of Good Mortgage Brokers

www.ihd.postlets.com

www.myroihome.wordpress.com

A good mortgage broker is something every potential homeowner or experienced real estate investor needs to have on their side.

There is no shortage of brokers out there and they come in all shapes and sizes with various personalities.

What people don’t realize is that if you have a very helpful and friendly broker, it can really make a difference in your entire attitude about getting a loan.

When you have a good mortgage broker, you will usually have a pretty stress-free loan process and they will be able to explain it all to you simply and easily.

So how do you know if you have a good broker There are some very simple things that will tell you right away if your broker is good or not.

One of the best ways to judge a mortgage broker is just with common sense. Does your broker like to talk and have an excited attitude

That can definitely improve the experience for you but there are other factors to consider. Punctuality is very important and someone missing dates can be infuriating.

If your broker says they will call at 6 pm and they miss it every time, it might be a problem. You really want someone very punctual.

The broker should be able to list off mortgages and programs by heart as well. It’s not a good sign if they are flipping through a book every few minutes to look up terms and arrangements.

A good way to tell if your mortgage broker is good is to make sure they are willing to answer any question imaginable without getting frustrated.

Ask them something a couple times in one sitting just to see what they do. If it’s obvious they are annoyed and don’t ask why you repeated it, they might not be paying attention and just reciting some spiel they use on everyone.

Subscribe to:

Posts (Atom)